nevada estate and inheritance tax

However an estate in Nevada is still subject to federal inheritance tax. Nevada State Personal Income Tax.

The Most Tax Friendly States For Retirees Vision Retirement

Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is responsible for paying the tax.

. Nevada also does not have a local estate. Ad Learn the 6 Biggest Estate Planning Mistakes Before You Invest in Your Family. Compare the best Estate Tax lawyers near Summerlin NV today.

Under Nevada probate law probate is the process of verifying the proper transfers of property after a persons death. The state imposes a 685 tax and counties may tack on up to. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Select Popular Legal Forms Packages of Any Category. The services provides thousands of web templates like the Nevada Estate and Inheritance Tax Return Engagement Letter - 706 which can be used for organization and private requires. Nevada does not have an inheritance tax.

No estate tax or inheritance tax. In 2021 the first 117mil per individual is. What Is The Sales Tax In Las Vegas.

No estate tax or inheritance tax. NV does not have state inheritance tax. Nevada is one of the seven states with no income.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. Property Tax Rate Range. Fortunately Nevada does not.

With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a. Just click print sign. The inheritance tax always goes hand-in-hand with the estate tax levied on the property of the recently deceased before it is transferred to heirs.

8192005 31444 PM. If any personal representative fails to pay any tax imposed by NRS 375A100 for which he or she is liable before the date the tax becomes delinquent he or she must on motion of the. Americas top legal Will provider.

The top inheritance tax rate is 16 percent no exemption threshold New Mexico. Inheritance and Estate Tax Rate Range. All Major Categories Covered.

The federal estate tax exemption is 1118. Find Out What to Look for When It Comes to Protecting Your Familys Future. But Nevada does have a relatively high sales tax a state rate is around 7 but.

There are no estate or inheritance taxes in the state either. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value.

Here are the answers to five common Nevada inheritance tax questions 775 823-9455. Technically the Las Vegas sales tax rate is between 8375 and 875. Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author.

Find an Attorney. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value. The sales tax in Las Vegas varies according to the business location.

Sales tax is one area where Nevada could do better. If the total amount of the deceased persons assets exceeds. The federal government IRS may impose an inheritance tax is the value of the deceased persons entire estate is over 55.

Use our free directory to instantly connect with verified Estate Tax attorneys.

Do You Pay Capital Gains Taxes On Property You Inherit

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Florida Gift Tax All You Need To Know Smartasset

Why You Need A Prenuptial Agreement Prenuptial Agreement Divorce Lawyers Prenuptial

Tax Provisions In The White House Build Back Better Framework The Good And Bad Itep

11 Ways The Wealthy And Corporations Will Game The New Tax Law Center For American Progress

Enrico Pobre Chief Executive Officer Integrated Insurance And Investments Inc Linkedin

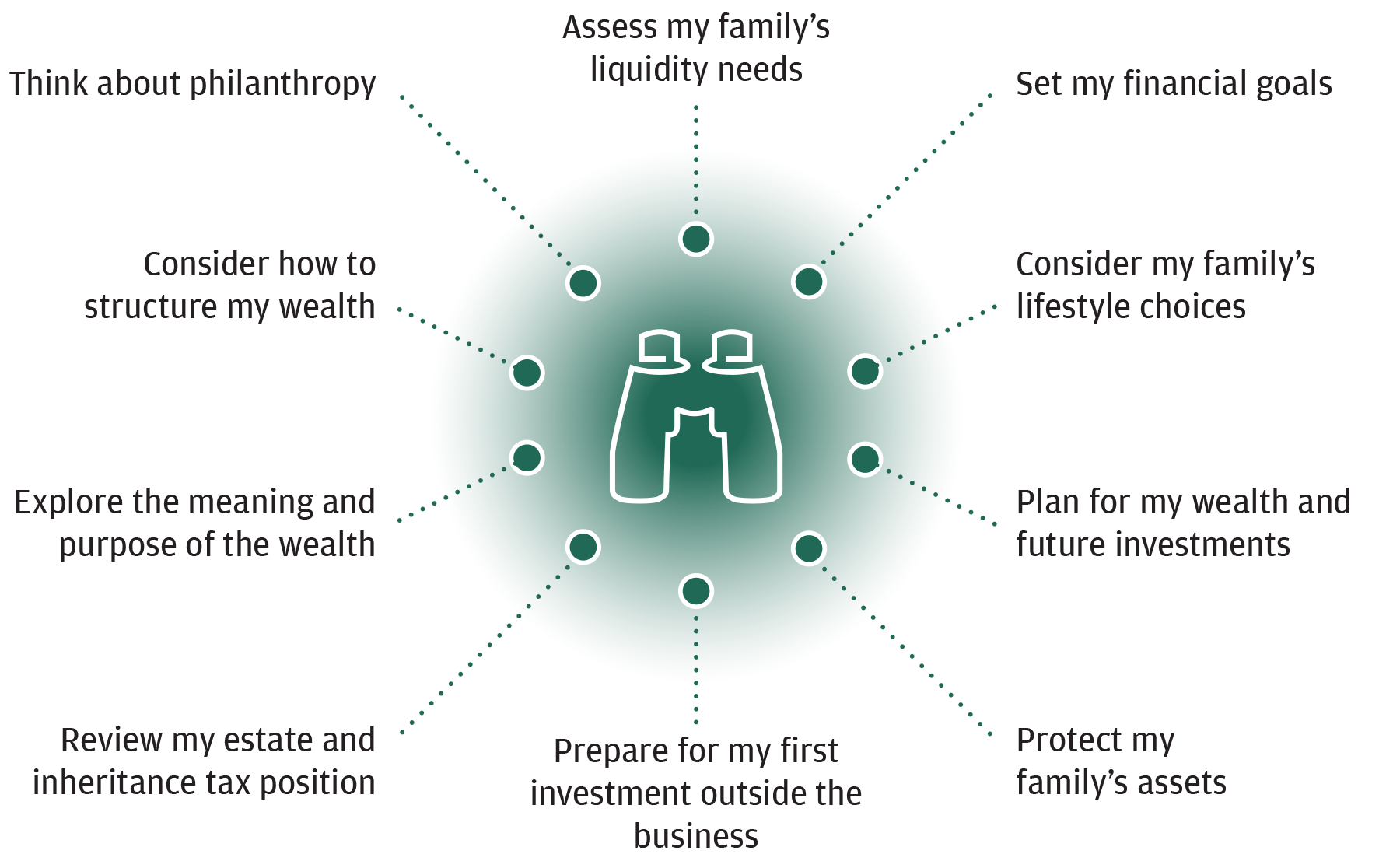

Selling Your Business J P Morgan Private Bank

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Pin On Uphold Our Constitution

What Is The Risk Period For A Donation Of Movable Assets Three Years Five Years Or Seven Years Villas Decoration

What Happens To Your Bank Account When You Die Dundas Life

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

11 Ways The Wealthy And Corporations Will Game The New Tax Law Center For American Progress

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate